———————————————————————————————–

28 July 2025, Sydney – Investment Trends has released the 22nd edition of its 2025 Adviser Technology Needs Report, delivering a comprehensive view of how Australian financial advisers engage with investment platforms and planning software. The study explores the drivers and barriers shaping platform selection, satisfaction and usage, while uncovering perceived strengths, weaknesses and unmet needs across the market.

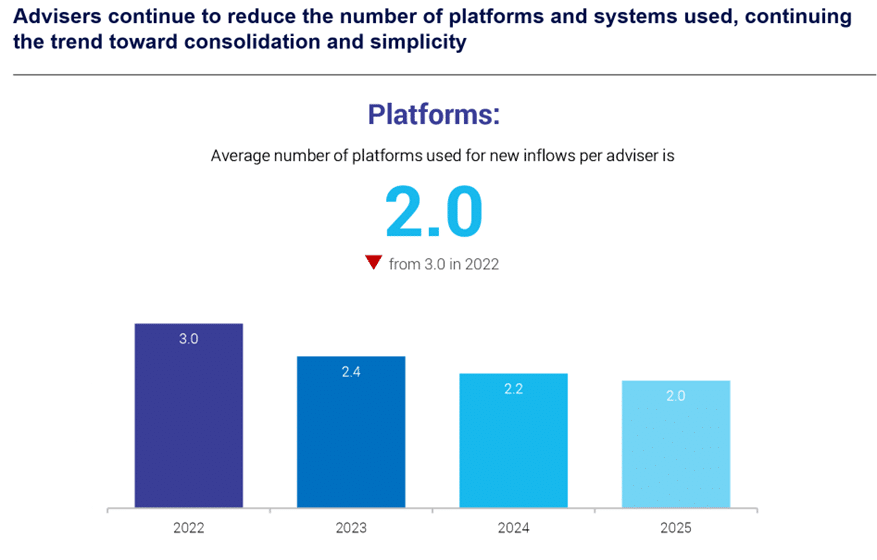

The latest report reveals a decisive trend toward platform consolidation. Advisers now use an average of just 2.0 platforms, down from 2.2 in 2024, and are funnelling a growing share of new business into a single provider. In 2025, 71% of new client inflows are directed to the adviser’s primary platform, up from 65% in 2022, reflecting advisers’ focus on simplicity, efficiency, and deeper integration.

“Advisers are no longer spreading flows across multiple platforms. They’re backing the ones that meet their expectations and can facilitate their preferred investment philosophy,” said Cameron Spittle, Director at Investment Trends. “This consolidation is deliberate and accelerating. For providers, retaining primary status is no longer about brand, it’s about delivering real usability, functionality and value.”

Copyright: Investment Trends. 2025 Adviser Technology Needs Report

The report also highlights a growing divergence in adviser technology strategies. One in four advisers (23%) now prefer a single, end-to-end solution, up from 18% last year, while nearly the same proportion (22%) favour open architecture with seamless integration. However, a significant 36% remain agnostic, and another 9% are unsure of their ideal setup.

“Technology spend has climbed to $38,000 per practice and it is more important than ever for platforms to be able to integrate seamlessly,” said Spittle. “Regardless of whether advisers prefer a fully integrated solution or best-of-breed technology stack.”

The report also shows that platform-based AI use cases and integration remain limited, but adviser demand for more sophisticated tools is growing. 61% of advisers now use AI, mostly via third-party solutions for simple tasks, but are increasingly seeking embedded, workflow-aligned tools to support more complex functions such as strategy development (62%) and meeting preparation (61%).

“AI has moved beyond the hype, advisers are engaging with it, and they’re signalling what they want next,” said Spittle. “Interestingly, when asked about their preferred access points for AI, advisers favour integration within their advice software, especially for client-facing and strategic tasks.”

About the report

The results are drawn from the Investment Trends 2025 Adviser Technology Needs Report, based on a quantitative online survey of 1,505 financial advisers conducted by Investment Trends between May and June 2025.

About Investment Trends

Investment Trends is one of the leading global researcher in the wealth management industry. We combine our analytical rigour and strategic thinking with the most advanced research and statistical techniques to help our clients gain a competitive advantage.

We have over 20 years of experience in researching the retail wealth management and global broking markets from which we provide new insights and decision-making support to over 130 leading financial service businesses globally. Investment Trends’ clients include global banking organisations, financial advice providers, fund managers, super funds, investment platform providers, all major online brokers and CFD providers as well as industry regulators and industry associations.

© 2026 Investment Trends. All Rights Reserved. Sydney Website Design by Wolf IQ