9 April 2025, Frankfurt – Investment Trends, the leading market research provider of actionable insights into trader behaviour has released the fifteenth edition of its 2025 Germany Leverage Trading Report. The report reveals early signs of recovery in the country’s leveraged trading market, driven by renewed participation and shifting product pathways.

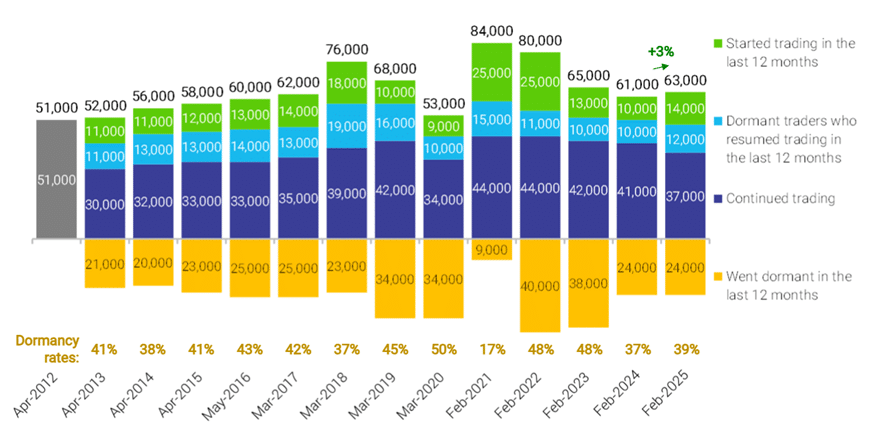

The report shows that Germany’s CFD/FX trading market has returned to growth for the first time in three years. In the 12 months to February 2025, 63,000 unique individuals placed at least one CFD or FX trade—a 3% increase from 2024. This resurgence is being fuelled by the reactivation of dormant traders, new client acquisition, and a relatively modest dormancy rate.

“This marks an important turning point for Germany’s CFD/FX market,” said Lorenzo Vignati, Associate Research Director at Investment Trends. “Providers have a real opportunity to re-engage previously lapsed clients while building sustained momentum with a new generation of traders entering from diverse product backgrounds.”

Retail German Leverage Trading Market Dynamics

Number of unique individuals who placed (at least) one leverage trade in the preceding 12 months

Note: Due to survey self-selection bias, these figures correspond to the number of traders active in any given 12-month period who intend to continue trading.

Copyright 2025: Investment Trends 2025 Germany Leverage Trading Report

While most leveraged traders in Germany begin their investing journey with shares or ETFs (72%), the latest cohort of new CFD/FX entrants is increasingly arriving via listed derivatives (33%) or cryptocurrencies (27%). This shift highlights the changing pathways into leveraged trading and suggests providers can benefit from tailoring their acquisition strategies accordingly.

“The profile of the new leveraged trader in Germany is evolving,” added Vignati. “They’re arriving more informed, more product-aware, and with different expectations of what a trading platform should deliver. Broker strategies must keep pace.”

At the same time, over four in five German CFD/FX traders are open to being cross-sold additional product types through their main CFD provider. Yet only 26% of multi-asset traders currently use the same platform for both trading and investing—underscoring an opportunity for greater integration.

“Cross-sell appetite in Germany is strong, but the experience gap is real,” Vignati noted. “To unlock value, providers need to build platforms that genuinely integrate trading and investing—making it seamless, intuitive, and supported by strong decision tools.”

The Investment Trends 2025 Germany Leverage Trading Report offers in-depth insights into the behaviour, needs, and expectations of leveraged traders in Germany, helping providers navigate a changing competitive landscape and identify areas for growth.

About the report

The results are drawn from the Investment Trends 2025 Germany Leverage Trading Report, based on a quantitative online survey of 11,680 traders and investors in Germany conducted between January to February 2025.

About Investment Trends

Investment Trends is the leading researcher in the retail trading and investing industry across the globe. We combine our analytical rigour and strategic thinking with the most advanced research and statistical techniques to help our clients gain a competitive advantage.

We have over 20 years of experience in researching the global trading and wealth management markets from which we provide new insights and decision-making support to over 130 leading financial service businesses globally. Investment Trends’ clients include global banking organisations, financial advice providers, fund managers, super funds, investment platform providers, all major online brokers and CFD providers as well as industry regulators and industry associations.

© 2026 Investment Trends. All Rights Reserved. Sydney Website Design by Wolf IQ