5 April 2025, Frankfurt – Investment Trends has today released the seventh edition of its 2025 Germany Listed Derivatives Report, revealing a strong rebound in retail participation and notable shifts in who is entering the market and how they are learning to trade.

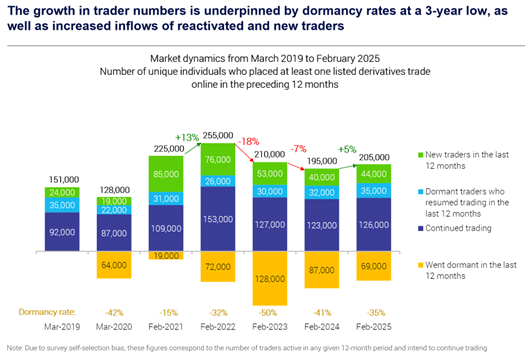

The latest report shows retail activity has bounced back, with 205,000 individuals having placed at least one listed derivatives trade in the past year, up from 195,000 in 2024. The turnaround is being driven by a three-year low in dormancy and increased flows from both reactivated and first-time traders.

“We’re seeing fresh energy in Germany’s listed derivatives market,” said Lorenzo Vignati, Associate Research Director at Investment Trends. “Lower dormancy levels, coupled with a wave of newly reactivated traders, are signs that retail interest in listed derivatives is not only alive but thriving.”

The study also finds that new German traders look very different from past cohorts. They are wealthier, with higher average household incomes and portfolio values. They’re significantly more likely to hold ETFs in their portfolios and are often attracted by the ability to invest with as little as €1,000 or less.

“Today’s new entrants into Germany’s listed derivatives market are more affluent, more ETF-savvy, and increasingly comfortable with starting small,” Vignati observed. “At the same time, the average trader is growing older and more financially sophisticated — the entire market is maturing.”

The report also indicates that a significant knowledge gap still exists, with 50% of listed derivatives traders describing themselves as novices or advanced beginners. To bridge this gap, many rely on stock exchange content, online search, and trading fairs, while AI tools are gaining popularity for market analysis and learning.

“There’s no shortage of information, but German listed derivative traders are becoming more discerning in how they learn,” added Vignati. “It’s encouraging to see a willingness to seek credible, structured education — whether that’s through exchanges, digital channels or emerging technologies.”

About the report

The results are drawn from the Investment Trends 2025 Germany Listed Derivatives Report, based on a quantitative online survey of 11,680 traders and investors in Germany conducted between January to February 2025.

About Investment Trends

Investment Trends is the leading researcher in the retail trading and investing industry across the globe. We combine our analytical rigour and strategic thinking with the most advanced research and statistical techniques to help our clients gain a competitive advantage.

We have over 20 years of experience in researching the global trading and wealth management markets from which we provide new insights and decision-making support to over 130 leading financial service businesses globally. Investment Trends’ clients include global banking organisations, financial advice providers, fund managers, super funds, investment platform providers, all major online brokers and CFD providers as well as industry regulators and industry associations.

© 2026 Investment Trends. All Rights Reserved. Sydney Website Design by Wolf IQ