9 April 2025, London – Investment Trends has released the 16th edition of its 2025 UK Adviser Technology & Business Report, offering an in-depth analysis of how financial advisers are evolving their practices amid rising regulatory demands, efficiency pressures, and technology transformation.

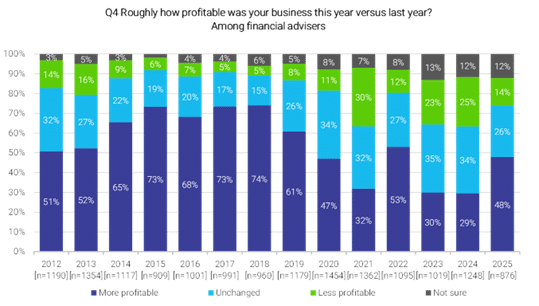

The latest report shows the UK advice industry is regaining momentum. Nearly half (48%) of financial advisers report improved year-on-year profitability, driven by more refined client segmentation and a stronger focus on high-value clients. Advisers are also managing slightly larger books, with the average number of active clients per adviser rising to 101, signalling a post-Consumer Duty recalibration across the sector.

“UK financial advisers have shown impressive adaptability,” said Lorenzo Vignati, Associate Research Director at Investment Trends. “They’re delivering more personalised service to a more defined client base—and now need technology that helps scale that impact. Smart automation and targeted insights are where the next leap in productivity will come from.”\

Copyright 2025: Investment Trends. 2025 UK Adviser Technology and Business Report

Copyright 2025: Investment Trends. 2025 UK Adviser Technology and Business Report

The need for better system integration has also emerged as a top concern. Half of financial advisers (50%) say seamless integration is a priority, while 41% are seeking AI-based tools to improve efficiency. When selecting platforms, advisers favour strong online functionality (58%), streamlined admin (47%) and reduced paperwork (32%).

“In today’s advice environment, disconnected systems are a drag on productivity,” Vignati added. “UK financial advisers don’t need a single solution to do everything—but they need their tools to work in sync. Providers that enable open data exchange will become central to adviser success.”

The report also highlights that financial advisers are recognising more platform brands—on average, each adviser can now recall 5.5 platform providers when prompted, up from 5.3 in 2024. Yet the number of platforms they actively use is consolidating, with the average falling to just 2.2 per adviser. The data also shows that financial advisers are expanding their technology use elsewhere, using an average of 3.7 planning software tools—highlighting the rising importance of integrated, specialised tech in delivering high-quality advice.

“Consolidation doesn’t equal simplification,” Vignati concluded. “Financial advisers are curating leaner, more connected tech stacks. The opportunity for platforms and software providers lies in collaboration—building ecosystems that support advisers, not silo them.”

About the report

The results are drawn from the Investment Trends 2025 UK Adviser Technology and Business Report, based on an in-depth study of 883 financial advisers, including practice principals who provide financial advice between January to February 2025.

About Investment Trends

Investment Trends is the leading researcher in the wealth management industry across the UK and Australia. We combine our analytical rigour and strategic thinking with the most advanced research and statistical techniques to help our clients gain a competitive advantage.

We have over 20 years of experience in researching the retail wealth management and global broking markets from which we provide new insights and decision-making support to over 130 leading financial service businesses globally. Investment Trends’ clients include global banking organisations, financial advice providers, fund managers, super funds, investment platform providers, all major online brokers and CFD providers as well as industry regulators and industry associations.

© 2026 Investment Trends. All Rights Reserved. Sydney Website Design by Wolf IQ