20 February 2024, Sydney – Investment Trends has released the 21st edition of its flagship 2024 Platform Competitive Analysis and Benchmarking Report, offering a comprehensive and statistically backed benchmarked analysis of how leading platforms are driving innovation and delivering on the evolving needs of advisers and investors.

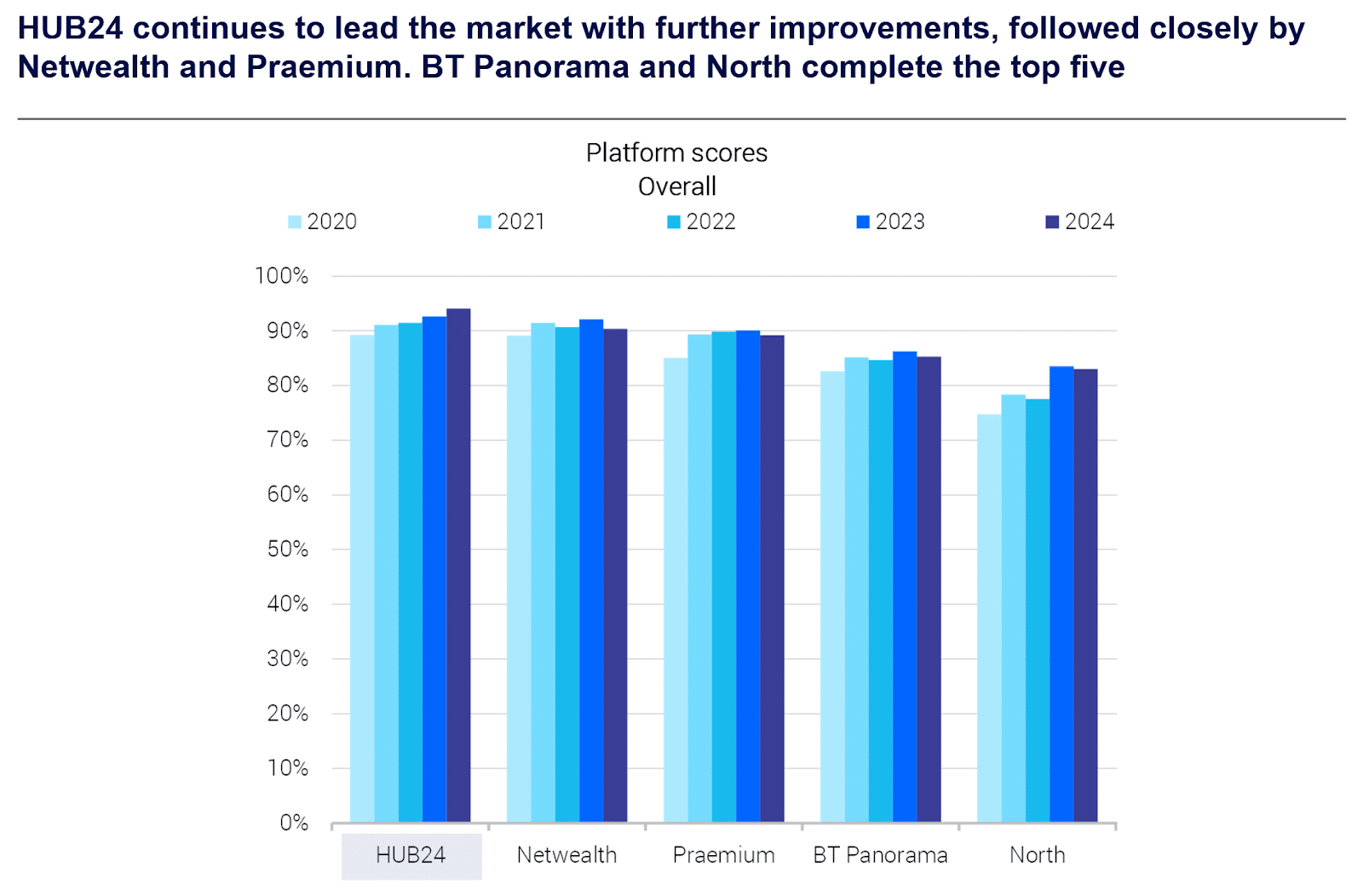

The latest report highlights sustained innovation across leading platforms, with HUB24 maintaining its leadership in overall functionality and achieving the most significant score increase, driven by wide-ranging enhancements. The top five full-function platforms for 2024 are HUB24 (94.0%), Netwealth (90.3%), Praemium (89.2%), BT Panorama (85.3%) and North (83.0%).

Copyright 2024: Investment Trends 2024 Platform and Competitive Analysis Benchmarking Report

Note: changes in scores are impacted by new criteria added, commoditised criteria removed and changes to weightings ascribed to each functionality as advised by the Platforms.

Platforms’ commitment to innovation is evident in the breadth of enhancements made throughout 2024,” said Paul McGivern, Director at Investment Trends. “As advisers increasingly segment their client bases, platforms are taking distinct strategic approaches to tailor their offerings to these segments.”

The report also highlights a growing focus on AI integration and cybersecurity, with many introducing AI tools to enhance efficiency around areas like file note transcription, portfolio commentary and education, but also security. Fraud prevention remains an important priority, with advancements in client authentication, biometric security, and fraud prevention education initiatives.

“Advisers are rapidly adopting AI, and platforms are responding with tools for education, portfolio insights, and transcription,” said McGivern. “And the platforms that haven’t already integrated these features are fast-tracking deployment for 2025.”

With retirement needs becoming a focus, the report shows platforms expanding their offerings to help advisers meet growing retiree demand. North leads with its Lifetime Income solutions, driving a sector-wide shift toward more tailored retirement products and services.

“Platforms are stepping up their efforts to address the growing retiree population, and the implications for RIC compliance and expected drawdowns,” said McGivern. “North has asserted strong leadership in this space with its innovative Lifetime Income solution, while HUB24 is also expanding capabilities. Broader industry adoption could significantly reshape the platform landscape.”

The report also shows platforms’ response to a surge in advisers and client demand for access to private markets. This evolution is evident across the platform’s investment menu, administration and reporting. The data also indicates a growing demand for streamlined tech stacks, with some platforms leveraging banking integrations for a competitive edge, while others build their own ecosystems through acquisitions.

McGivern concluded, “as advisers seek efficiency and differentiation, platforms that can deliver seamless functionality, security, and innovative investment solutions will stand out in an increasingly competitive market”.

| Media enquiries contact: |

| Sophie O’Neill, Senior Marketing Manager, Investment Trends Phone +61 2 8248 8000 Email s.oneill@investmenttrends.com |

About the report

The Investment Trends’ flagship 2024 Platform Competitive Analysis and Benchmarking Report is based on qualitative benchmarking via data collection and interviews with platform providers from September to December 2024 covering functionality available to platform users as at 31 December 2024.

About Investment Trends

Investment Trends is the leading researcher in the wealth management industry across the UK and Australia. We combine our analytical rigour and strategic thinking with the most advanced research and statistical techniques to help our clients gain a competitive advantage.

We have over 20 years of experience in researching the retail wealth management and global broking markets from which we provide new insights and decision-making support to over 130 leading financial service businesses globally. Investment Trends’ clients include global banking organisations, financial advice providers, fund managers, super funds, investment platform providers, all major online brokers and CFD providers as well as industry regulators and industry associations.

© 2024 Investment Trends. All Rights Reserved. Agency Website by Wolf IQ